The Current State Of The Market

The Current State Of The Market

by Larry Osmond

May 12, 2025

While it always makes sense to focus on what’s happening in your neighbourhood, this month I’m sharing a broader view as I think it’s also important to be mindful of the market at large. As of May 2025, Ontario's real estate market is experiencing a notable shift, characterized by increased inventory, moderated price growth, and evolving buyer dynamics. Here's an in-depth look at the current landscape:

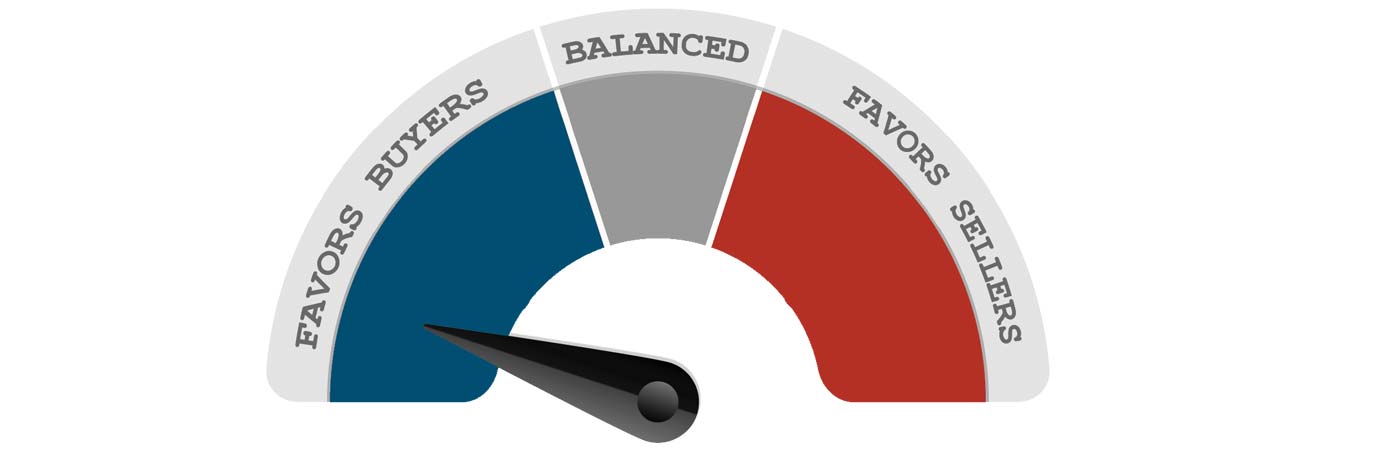

Market Overview: Transitioning to a Buyer's Market

Ontario's housing market has seen a significant rise in inventory. As of the end of April 2025, the number of active residential listings surged by 28.8% year-over-year, reaching 66,952 – the highest April level in a decade. In fact, active listings in April 2025 were 53.3% greater than the 10-year average for the month of April. Also noteworthy is that new listings in Ontario are also trending higher. For April 2025, new listings were 9.7% higher than the 10-year average for the month of April.

In contrast to rising inventory, residential sales in Ontario have dipped significantly with a total of 14,244 sales in April 2025. This figure is 20.2% lower than April 2024. It’s also 30.7% under the 10-year average for the month of April.

What do all these numbers mean? Provincially, it’s a Buyer’s Market with 4.7 months of inventory as of the end of April 2025. This slowdown reflects cautious buyer sentiment amid economic uncertainties as an international trade war continues to impact Canada.

Price Trends: Regional Variations

Despite the cooling market, average home prices in Ontario have remained relatively stable. As of April 2025, the average home price was $859,645, a 4.8% decrease year-over-year. However, regional disparities are evident:

- Oakville: Average sale price down 4.6% to $1,513,732.

- Burlington: Average sale price increased 2.4% to $1,178,724.

- Toronto: Minimal change, a dip of just 0.6%, to average price of $1,144,977.

- Hamilton: Average sale price decreased 3.2% to $791,384.

- GTA: Average sale price at $1,107,463, down 4.1% year-over-year.

Affordability and Buyer Sentiment

Housing affordability remains a significant concern. Desjardins Securities projects that affordability, already at a near four-decade low, will not show significant improvement for at least the next two years. While anticipated Bank of Canada rate cuts are expected to reduce mortgage debt costs, they may also drive home prices higher, potentially offsetting affordability gains. Further, economic uncertainties, including trade tensions between Canada and the United States, have further dampened buyer confidence.

Market Outlook for Buyers and Sellers

Looking ahead, the market is expected to remain in a buyer-friendly position, with increased inventory providing more options for purchasers. However, affordability challenges and economic uncertainties may continue to influence buyer behavior. Prospective buyers and investors should stay informed and consider regional variations when making decisions in Ontario's evolving real estate landscape.

For sellers seeking a successful sale in a reasonable timeline, it’s critical to stand out in a larger pool of available inventory. To achieve this, a strategic approach, including staging consultation, needed repairs completed, deep cleaning, and decluttering is critical. It also means being finely tuned into local pricing in your community. An overpriced property will languish on market when more competitive options exist.

Get In Touch

As your trusted resource for all things real estate, I’d be more than happy to provide you with additional insight on how to best prepare for buying or selling real estate. If you have any questions about the market, please reach out anytime. Want a better real estate experience?

Let’s chat.